Quick links

Our latest news

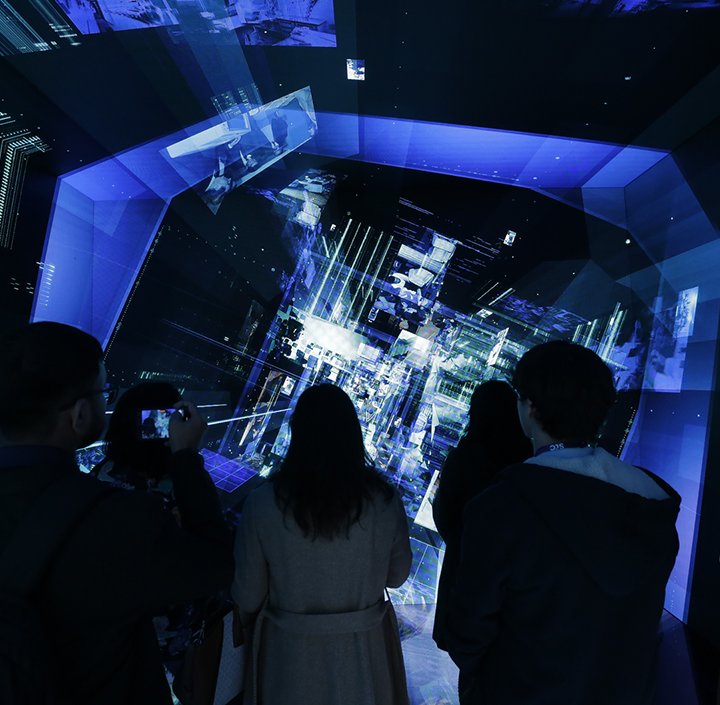

The GSMA at Hannover Messe 2024

Come and meet us at the world’s leading industrial trade fair – where we’ll be showcasing how the GSMA can help to grow your business with better industry connections, more informed decision-making and access to data-led industry insights.

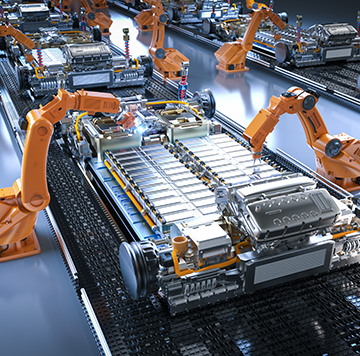

MWC Barcelona 2024 Manufacturing Summit highlights.

Membership: welcome to connected manufacturing & production

Whitepaper: 5G deterministic networks for industries

Join in with the Connected Manufacturing forum meeting.

See how our services can help your connected industry thrive.

Worldwide connectivity events

Highlights

MWC Barcelona

26-29 February, 2024

Upcoming

M360 Eurasia

15-16 May, 2024

Baku, Azerbaijan

Get involved

GSMA membership

Join our 15,000-strong community of industry experts – it’s your opportunity to form lasting business relationships and direct the future of mobile technology.

Meet the GSMA

Learn about the mobile industry’s commitment to the UN’s Sustainable Development Goals, who’s on our board, what it’s like to work here and our history.

Latest global data

GSMA Intelligence brings unrivalled insight into shifts in the mobile industry, supporting mobile operators with strategic decision-making and long-term investment planning.

You can easily size up markets, profile competitors and future-proof business planning. Plus, our expert analyst team is available to help guide you.

Get more key data